Summa Equity has agreed to sell Lakers to Vestum for SEK 2bn

Summa Equity has signed a definitive agreement to sell Lakers Group Holding AS (“Lakers” or the “Company”), a leading and independent aftermarket service provider of water and wastewater pumps to Vestum AB (publ) (“Vestum”) for a total consideration of approximately SEK 2bn, of which c. SEK 250m will be reinvested into Vestum.

- News

3 min read

Since Summa Equity’s acquisition of Lakers in 2018, the Company has grown rapidly through organic initiatives and a series of 14 acquisitions across the Nordic region, United Kingdom and Germany.

“Our investment in Lakers was founded in Summa Equity’s philosophy of investing to solve global challenges, and Lakers solves issues with our ageing water and sanitation infrastructure. We are excited about Vestum’s acquisition, which is validating our thesis on consolidating and improving the service industry for water infrastructure,” says Christian Melby, Partner and CIO at Summa Equity.

The Company contributes to improve SDG #6 (Clean Water and Sanitation) and #9 (Industry, Innovation, and Infrastructure) and serves as an important partner for the maintenance and service of our water and sanitation infrastructure.

“We are proud to have been part of Lakers journey since 2018, growing revenues fourfold and operating result sixfold through a swift expansion of its footprint across the Nordics and into Germany and the UK,” says Johannes Lien, Principal at Summa Equity.

Lakers is the leading independent waste and wastewater pump service provider in Northern Europe focused on product offerings within aftermarket products and services such as rental, maintenance, product manufacturing and sales, and projects across Sweden, Norway, Denmark, Finland, Germany, and the United Kingdom.

“We have had a fantastic partnership with Summa in building a company that truly delivers on our mission of “Making Water Work” through providing the best possible service and products to our customers. We are excited about continuing this journey with Vestum, as they are also strongly aligned with our ambition to continue to consolidate the industry in Europe so that Lakers can improve how we address the sustainability challenges in our aging water and sanitation infrastructure,” says Carl-Johan Callenholm, CEO of Lakers.

Cederquist and Selmer has been acting as legal advisors to Lakers.

For further information, please contact:

Hannah Gunvor Jacobsen, Head of IR Summa Equity

+47 93 64 19 60

hannah.jacobsen@summaequity.com

About Lakers

Lakers is a North European aftermarket service, project and product provider of water and wastewater pumps, which serve as key components for transportation of water in the water infrastructure. The Company was founded by Carl-Johan Callenholm (CEO) and Carl Hall (Board Member and Head of M&A) in 2016 and is headquartered in Oslo, Norway with more than 400 FTEs. Lakers operates within Pump Service, Aftermarket Projects and Niche Products through its 25 entities in Norway, Sweden, Denmark, Finland, Germany and the United Kingdom.

About Summa Equity

Summa invests in companies that are solving global challenges and creating positive Environmental, Social, and Governance (ESG) outcomes for society.

Summa’s purpose is to co-create win-win for investors, portfolio companies, and society through aligning its vision and outcomes to the Sustainable Development Goals, ensuring a net-positive impact against ESG challenges, and the potential for long-term, sustainable outperformance.

Investments are focused on industries and companies within three sustainability megatrends: Resource Efficiency, Changing Demographics, and Tech-Enabled Businesses. Across these themes, Summa’s portfolio companies are supporting a world in transition and showing that business can be part of the solution. Summa has more than €1.6bn of assets under management.

The Summa Summarum newsletter

Sign up to our newsletter

Latest readings

News

Reflections from the Summa Summit and our 9th Annual Investor Meeting 2025

Read more

Summa Equity completes full exit of Infobric

Read more

Investing in cybersecurity for a secure and resilient digital future

Read more

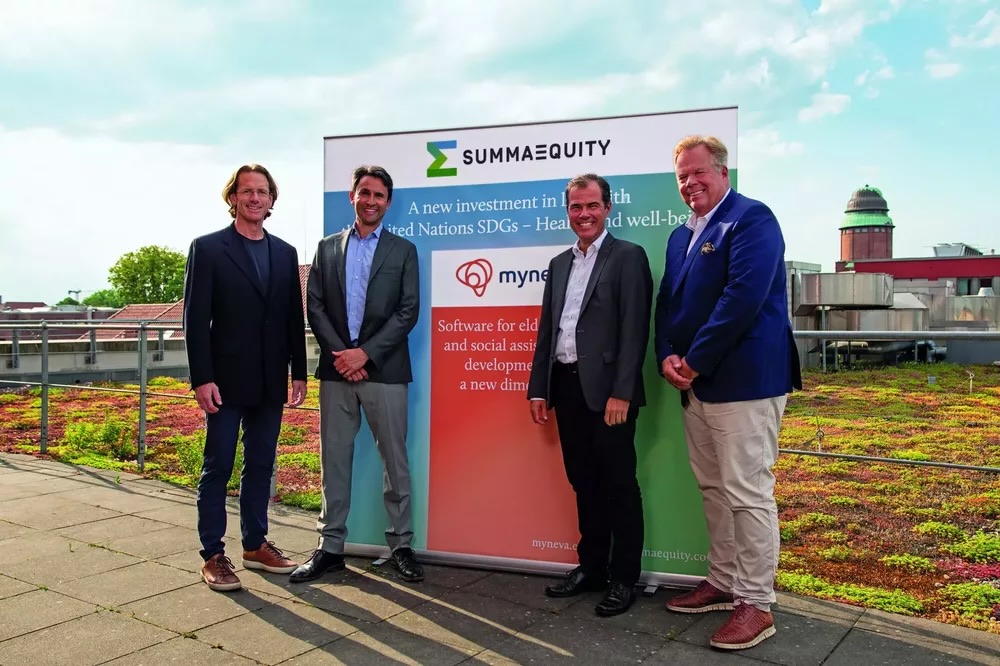

myneva Group, part of Summa Equity, acquires Kuidado GmbH and strengthens digitalization in social sector

Read more

Summa Equity adds Schulz & Berger to its waste equipment platform to accelerate growth and innovation in circular economy technologies

Read more