For investors

Investing to solve global challenges

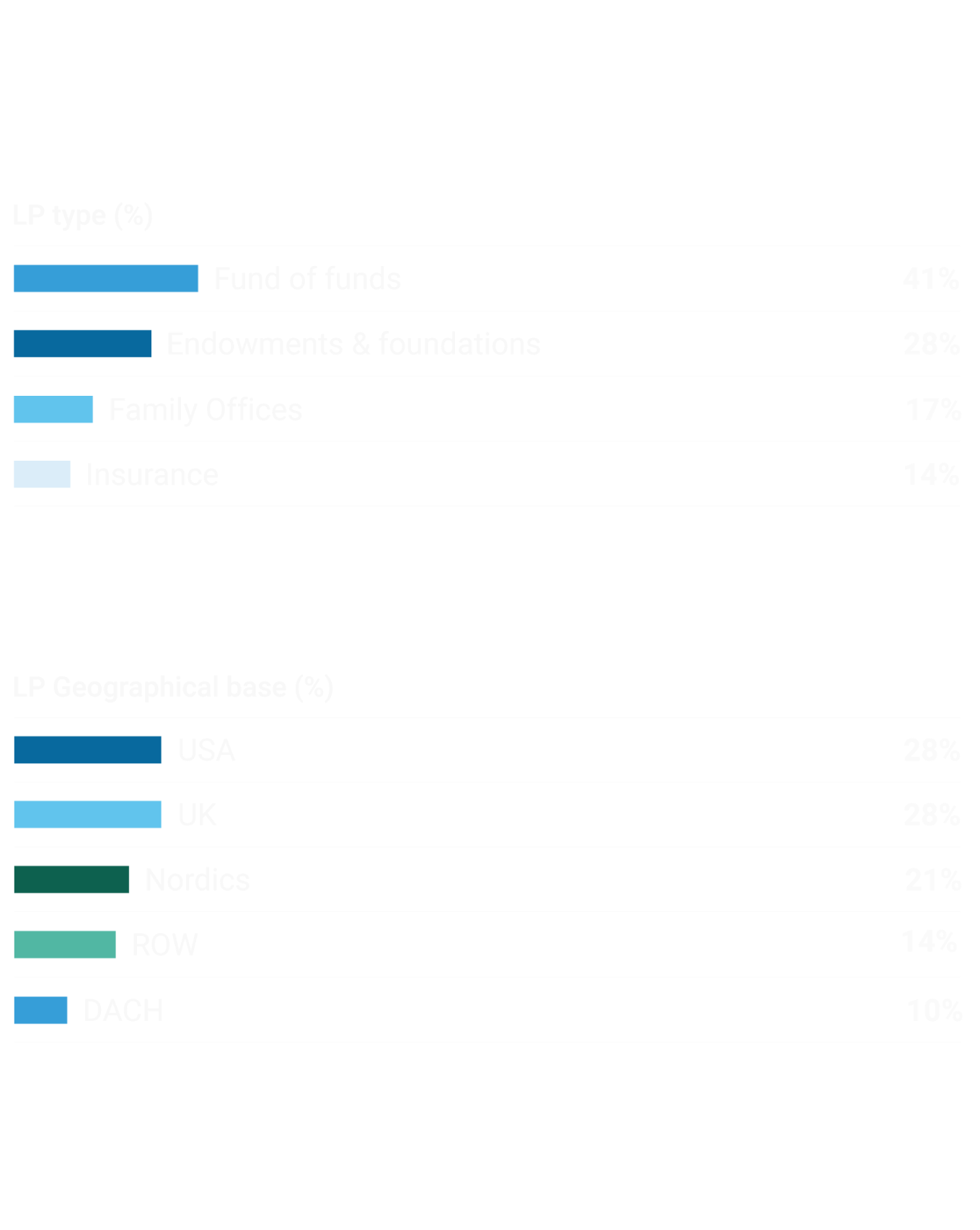

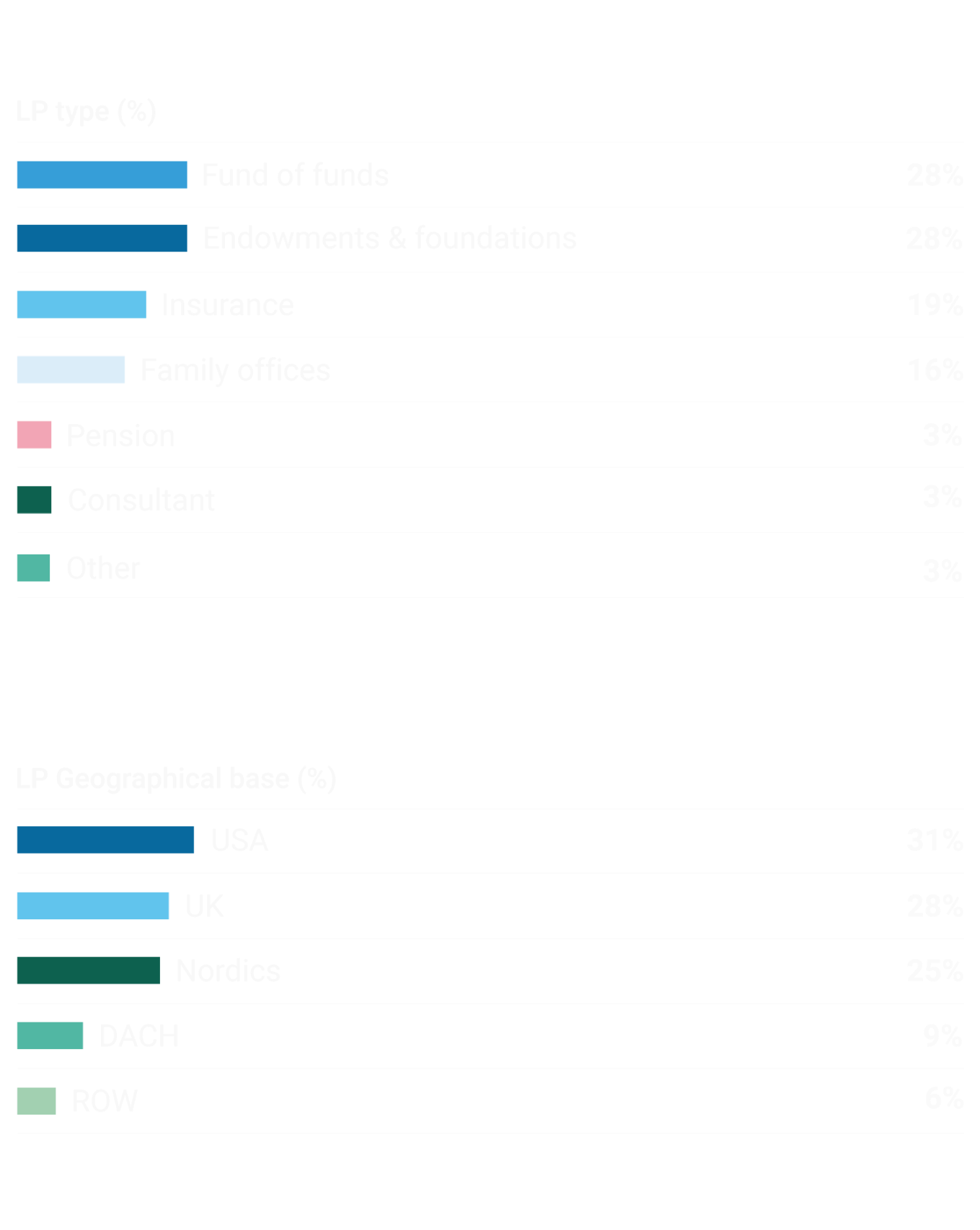

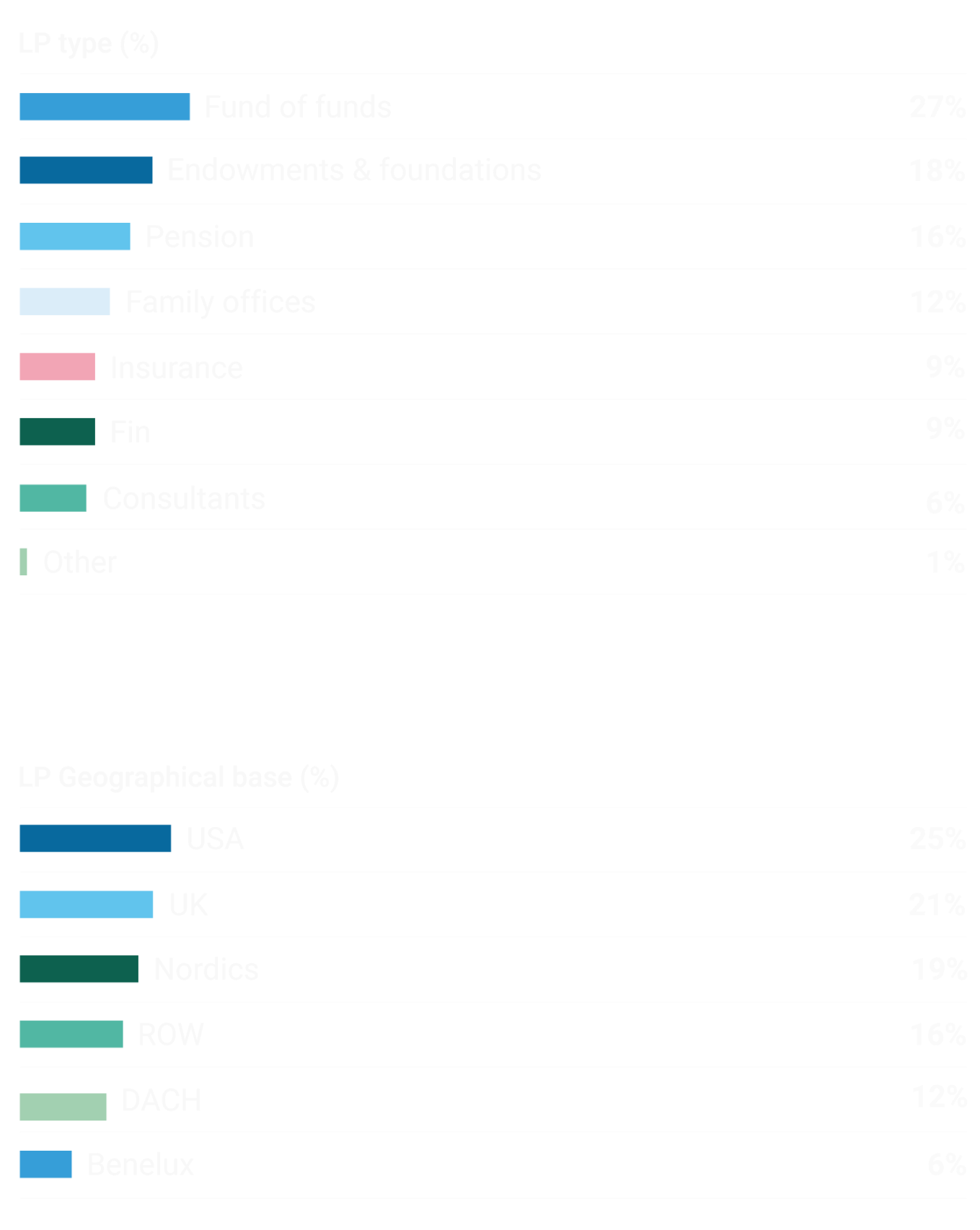

Investors

Thematic investments

Summa is a thematic investment manager defined by team that has come together to invest in companies that address some of the global challenges we are facing today.

We focus on industries supported by megatrends within four themes: Circularity, Sustainable Food, Energy Transition and Tech-Enabled Resilience. Our portfolio companies across the four themes have the potential for long-term sustainable outperformance since they help address material social, environmental and governance challenges that we need to solve as a society.