LOGEX, Ivbar, and Prodacapo join forces to create a European market leader in advanced costing and quality analytics for healthcare

With the aim of strengthening their ability to inform and support sustainable quality improvements, transparency and efficiency in healthcare LOGEX, Ivbar, and Prodacapo have decided to join forces through the new LOGEX Group. This will create a European market leader in advanced software for analysing outcomes and costs in healthcare.

- News

- Changing Demographics

3 min read

Today, the three companies all hold leading positions in their respective markets – the Netherlands, Sweden, Finland, Norway, UK and France. The new LOGEX Group will have unmatched capacities to support a holistic approach to improvement in healthcare through advanced analytics. It brings together leading capabilities from quality and costing analytics:

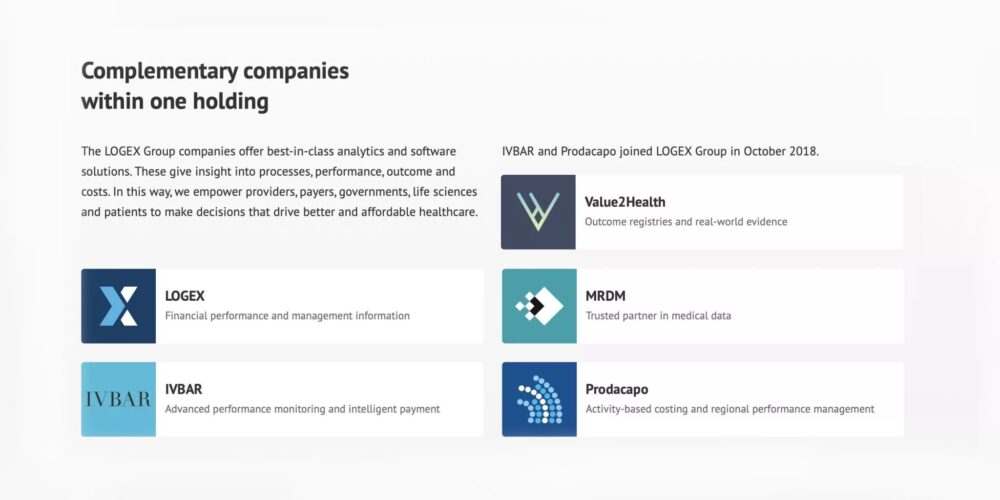

- LOGEX is headquartered in Amsterdam and the pacesetter in the Dutch market for costing analytics, providing advanced solutions for cost tracking, budgeting and planning in healthcare. LOGEX also comprises Value2Health and MRDM. Value2Health, being the Dutch market leader in healthcare quality analytics, specializes in giving healthcare providers, receivers or organisers, access to reliable information making it possible to improve quality and outcomes. MRDM are experts in the field of data security and privacy.

- Ivbar is headquartered in Stockholm and is a market leader in Sweden in providing technical solutions for efficiency analytics and management of advanced payment models. Its mission is to support healthcare organisations to sustainably improve outcomes.

- Prodacapo is headquartered in Helsinki and is the market leader in Finland, Sweden and Norway in costing analytics for the healthcare sector. Prodacapo also has a strong presence in the UK market.

The new LOGEX Group will create a favourable environment to allow for the companies to develop their core competencies and product portfolio further, with the aim of providing even stronger solutions to all stakeholders in the healthcare system, including providers, payers and authorities.

“As we create a larger international group, customers will benefit from a more versatile product portfolio that meets a broader spectrum of their needs as they strive to drive improvements in their operations. Utilizing our tools to drive transparency and understanding of outcomes, resource use and costs in healthcare, will help our customers in their development, and ultimately benefit patients and society,” says Philipp Jan Flach, CEO of LOGEX Group.

As healthcare expenditure constitutes a growing share of GDP in many European markets and healthcare budgets are under pressure, the demand for tools to increase efficiency and understand patient outcomes increases. The enlarged group will offer a holistic product offering, with strong potential to address these challenges.

“Being able to provide our customers with deep insights on patient outcomes as well as costs and resources used in healthcare is unique, and extraordinarily important if we are to solve the challenges posed to our healthcare systems today,” says Kari Lappalainen, CEO of Prodacapo.

LOGEX Group will be headquartered in Amsterdam with offices across Sweden, Finland, Norway, UK, France, Czech Republic and other locations in the Netherlands. This scope of operations provides the group a broad perspective on healthcare systems in Europe.

“Broadening our geographical footprint, becoming a truly European company will create unmatched opportunities to benchmark healthcare performance across markets, regions and patient groups. This will provide invaluable insight for all stakeholders with an interest to improve healthcare,” says Jonas Wohlin, CEO of IVBAR.

The new LOGEX Group will have more than 250 employees. Phillip Jan Flach will be CEO of the new group.

The Summa Summarum newsletter

Sign up to our newsletter

Latest readings

News

myneva Group, part of Summa Equity, acquires Kuidado GmbH and strengthens digitalization in social sector

Read more

Summa Equity adds Schulz & Berger to its waste equipment platform to accelerate growth and innovation in circular economy technologies

Read more

The case for scalable regenerative agriculture

Read more

Investing in food and agriculture for health and planetary resilience

Read more

NetGuardians and Intix unite to form Vyntra

Read more