Funds

Funds focused on impact

As the population and economy grow and technology transforms society, we face increasing challenges. However, these challenges provide tremendous opportunities as making the world more future-proof requires us to adopt new and innovative solutions.

Summa seeks to invest in and develop companies that provide these solutions. The binding element of Summa’s investment strategy is that our portfolio companies deliver products or services with a meaningful alignment and value creation strategy towards the UN’s SDG framework within four investment themes: Circularity, Sustainable Food, Energy Transition and Tech-Enabled Resilience. The funds are supported by a diverse base of institutional investors.

-

Summa Equity Fund I

Summa Equity Fund I (“Fund I”) held its final close in 2017 and is a Nordic focused buyout fund. The fund closed with commitments of SEK 4.7 bn, exceeding the initial target of SEK 3.3...- Vintage

- 2017

- Fund size

- c. SEK 4.7 bn

- Current investments

- 1

- Exited investments

- 9

-

Summa Equity Fund II

Summa Equity Fund II (“Fund II”) held its final close in 2019 and is a Nordic focused buyout fund. Fund II closed at a hard cap with investor commitments of SEK 6.8 bn. Fund II...- Vintage

- 2019

- Fund size

- c. SEK 6.8 bn

- Current investments

- 5

- Exited investments

- 4

-

Summa Equity Fund III

Summa Equity Fund III (“Fund III”) has a vintage of 2022 and has a mandate to invest in Nordics and Northern Europe as a buyout and growth Article 9 fund. The capital in Fund III...- Vintage

- 2022

- Fund size

- c. EUR 2.3 bn

- Current investments

- 14

- Exited investments

- -

-

Summa Circular

Summa Circular closed in 2023 and is an Article 9 continuation fund for NG Group (“NG”), a leading Nordic provider of circular solutions and environmental services. NG was originally acquired by Summa Equity Fund I...- Vintage

- 2023

- Fund size

- c. EUR 550 m

- Current investments

- 1

- Exited investments

- -

-

Summa Foundation

The main purpose of the Summa Foundation is to promote prosperous societies and ecology. The purpose of the Foundation will be fulfilled, directly or indirectly, through charitable donations, investments in social, cultural or environmental enterprises...- Vintage

- 2016

- Donations deployed

- c. EUR 6 m

- Main partnerships

- 5

- Initiatives/organizations supported

- 20

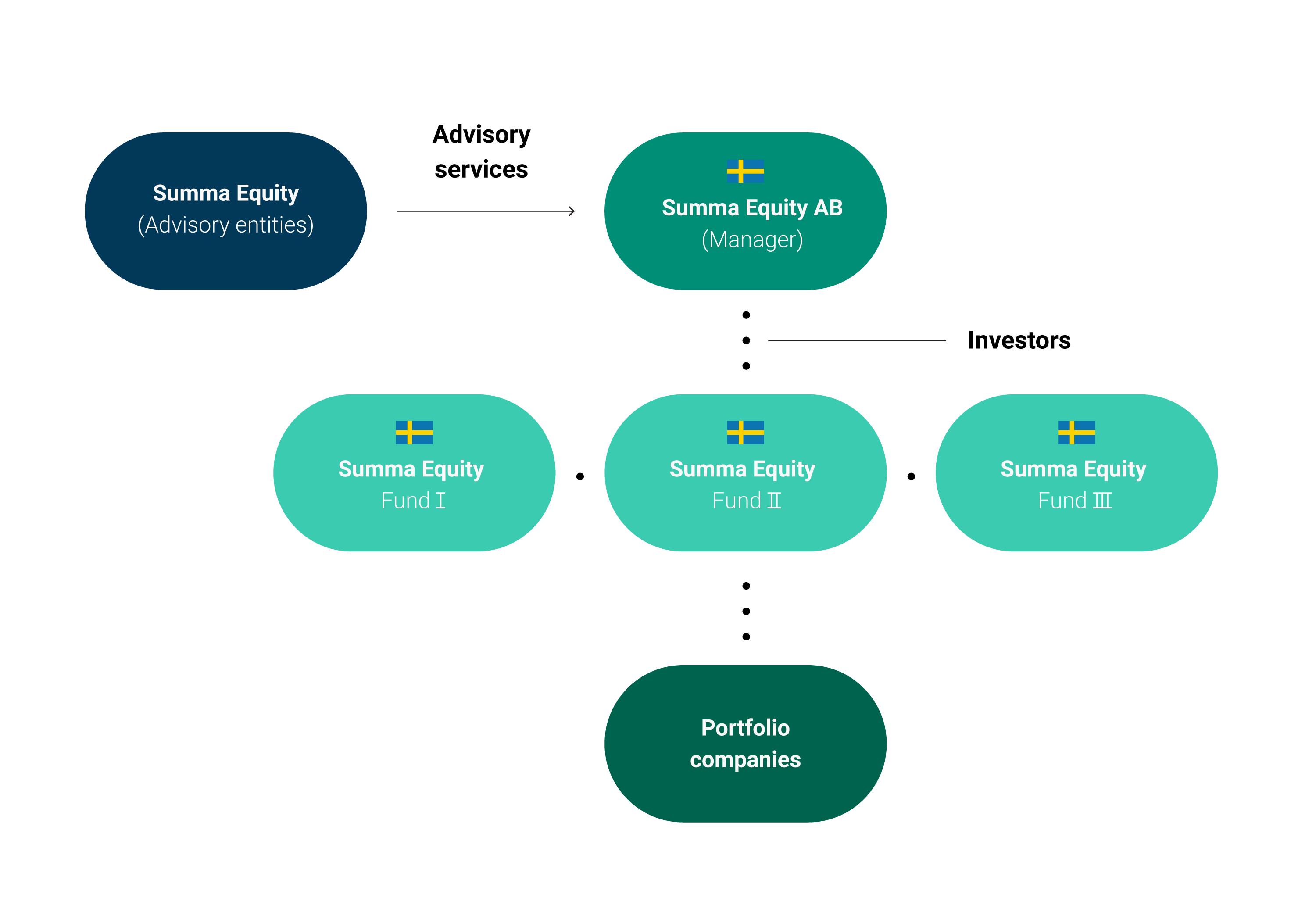

Fund structure

Summa has three live funds, Summa Equity Fund I, Summa Equity Fund II, and Summa Equity Fund III, established and domiciled in Sweden. The fund vehicles and their manager are regulated by, and under the supervision of, the Swedish Financial Supervising Authority (SFSA).

The fund manager (Summa Equity) will act as manager in accordance with the Swedish Alternative Investment Fund Managers Directive (2013:561), the Swedish implementation of the Alternative Investment Fund Managers Directive (2011/61/EU).

The Summa Equity funds acts through its manager and typically invest through special purpose vehicles (SPVs), see simplified chart over a Summa fund structure. Summa Equity is responsible for all investment and divestment decisions.

The Summa Equity advisory entities established in Norway, Germany and the US are operated independently and acts as sub-advisors providing non-binding advice and recommendations to the manager.

For investors

Would you like to learn more about our funds?