Investing to solve global challenges

About us

Summa Equity

Summa Equity was created to solve global challenges

Summa Equity is a thematic investment firm, considering the world’s uncertainties as opportunities.

Our founder, Reynir Indahl, a successful investor with a robust portfolio, was shaken in the aftermath of the 2008 financial crisis. Like many, he had not seen it coming and was eager to understand the root causes of the crisis.

I delved into the financial system and read extensively about issues like climate change and inequality. I was caused to question whether I was truly making a positive difference in the world. Looking in the mirror I realized I was part of the problem, not the solution.

Determined to change his ways, Reynir began working with philanthropic projects alongside the Princely family of Liechtenstein. In 2015, he drafted a concept note outlining the vision for what would become Summa Equity. Since its inception, Summa Equity has been a thematic investment firm. Defined by an ambitious and compassionate team that has come together to invest in companies that address some of our global challenges.

We focus on companies in industries supported by megatrends within four themes: Circularity, Sustainable Food, Energy Transition and Tech-Enabled Resilience. Our investments across the three themes have the potential for long-term sustainable outperformance because they address some of the social, environmental, and business challenges we need to solve as a society.

At a glance

- Sector

- Private Equity

- Funds raised

- c. EUR 4bn

- Established

- 2016

- Investments

- 33

- Market position

- Mid Cap

- Strategy

- Thematic

- Funds

- 3

- Employees

- ~80

Funds

-

Summa Equity Fund I

Summa Equity Fund I (“Fund I”) held its final close in 2017 and is a Nordic focused buyout fund. The fund closed with commitments of SEK 4.7 bn, exceeding the initial target of SEK 3.3...- Vintage

- 2017

- Fund size

- c. SEK 4.7 bn

- Current investments

- 1

- Exited investments

- 9

-

Summa Equity Fund II

Summa Equity Fund II (“Fund II”) held its final close in 2019 and is a Nordic focused buyout fund. Fund II closed at a hard cap with investor commitments of SEK 6.8 bn. Fund II...- Vintage

- 2019

- Fund size

- c. SEK 6.8 bn

- Current investments

- 6

- Exited investments

- 3

-

Summa Equity Fund III

Summa Equity Fund III (“Fund III”) has a vintage of 2022 and has a mandate to invest in Nordics and Northern Europe as a buyout and growth Article 9 fund. The capital in Fund III...- Vintage

- 2022

- Fund size

- c. EUR 2.3 bn

- Current investments

- 12

- Exited investments

- -

-

Summa Circular

Summa Circular closed in 2023 and is an Article 9 continuation fund for NG Group (“NG”), a leading Nordic provider of circular solutions and environmental services. NG was originally acquired by Summa Equity Fund I...- Vintage

- 2023

- Fund size

- c. EUR 550 m

- Current investments

- 1

- Exited investments

- -

-

Summa Foundation

The main purpose of the Summa Foundation is to promote prosperous societies and ecology. The purpose of the Foundation will be fulfilled, directly or indirectly, through charitable donations, investments in social, cultural or environmental enterprises...- Vintage

- 2016

- Donations deployed

- c. EUR 6 m

- Main partnerships

- 5

- Initiatives/organizations supported

- 20

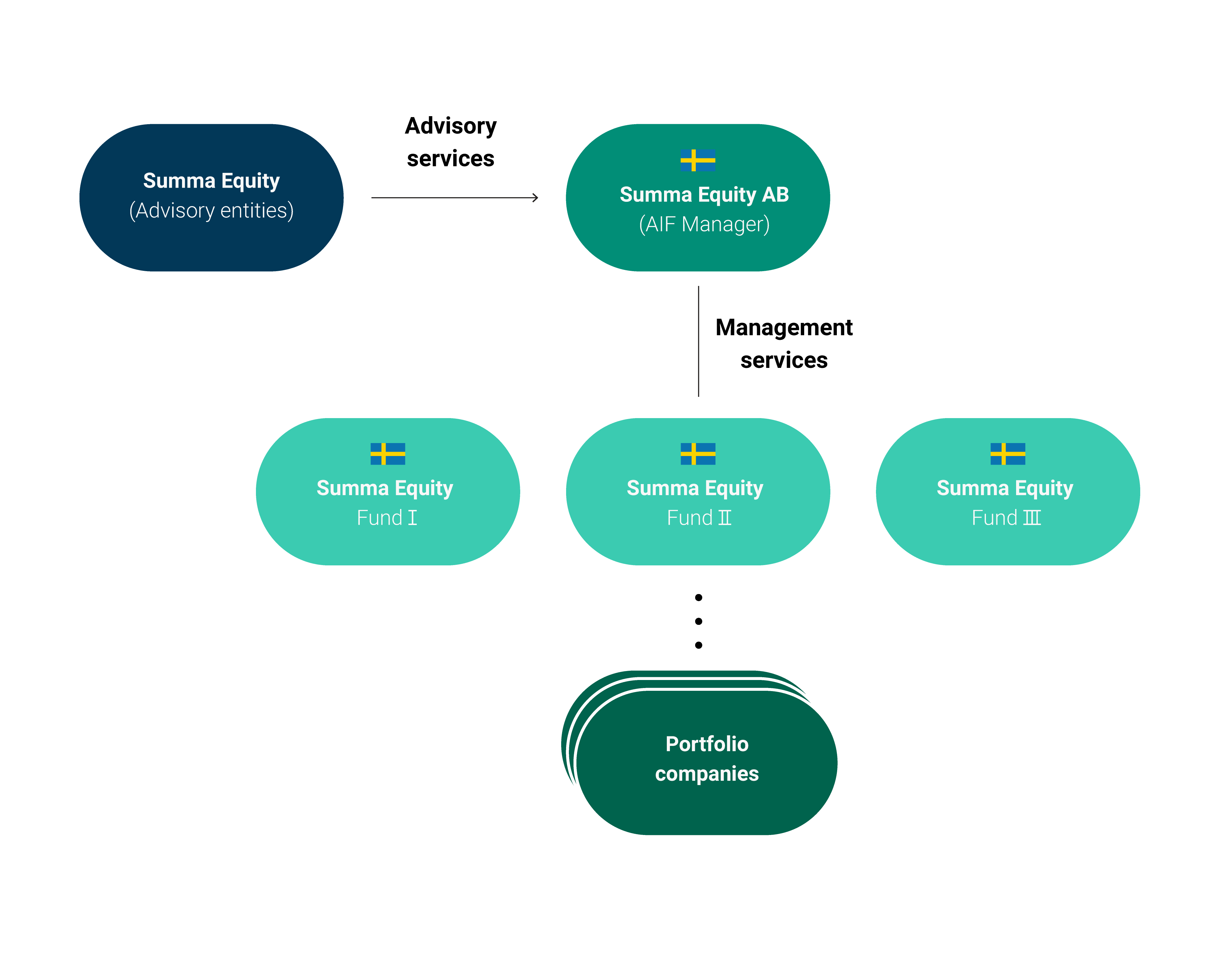

Fund structure

Summa Equity has three live funds, Summa Equity Fund I, Summa Equity Fund II, and Summa Equity Fund III, established and domiciled in Sweden. The fund vehicles and their manager are regulated by, and under the supervision of, the Swedish Financial Supervising Authority (SFSA).

The fund manager (Summa Equity) will act as manager in accordance with the Swedish Alternative Investment Fund Managers Directive (2013:561), the Swedish implementation of the Alternative Investment Fund Managers Directive (2011/61/EU).

The Summa Equity funds acts through its manager and typically invest through special purpose vehicles (SPVs), see simplified chart over a Summa fund structure. Summa Equity is responsible for all investment and divestment decisions.

The Summa Equity advisory entities established in Norway, Germany and the US are operated independently and acts as sub-advisors providing non-binding advice and recommendations to the manager.

Impact investing

Private Equity 4.0

Summa’s investment strategy is based on the view that our biggest challenges are also our biggest investment opportunities, given that the demand for solutions to these challenges is growing.

Using ESG to create more value with less risk is the essence of Private Equity 4.0. Listen to our Founder & Managing Partner, Reynir Indahl, explain the movement of PE 4.0, and why this is integrated in our investment thesis.