Summa's approach to impact investing

The document reflect the most recent regulatory guidance and learnings from Summa investments made to date. Over time, we will continue to refine these guidelines based on the latest thinking and accepted standards for impact investing. Our hope is that this serves to create more transparency for Summa’s work and contributes to ongoing dialogue in the space about how to invest with impact intentionality.

- Impact

15 min read

Purpose

We have summarized Summa Equity’s (“Summa’s”) approach to investing with impact intentionality as a complement to existing materials, including Summa Equity Fund III Pre-Contractual Disclosure. Specifically, we have described Summa’s impact investment strategy (i.e., what kind of impact investments will Summa make?) and how impact is integrated across the investment process from sourcing to investment decision-making and beyond.

The document reflect the most recent regulatory guidance and learnings from Summa investments made to date. Over time, we will continue to refine these guidelines based on the latest thinking and accepted standards for impact investing. Our hope is that this serves to create more transparency for Summa’s work and contributes to ongoing dialogue in the space about how to invest with impact intentionality.

Context: Operating in an ambiguous environment

The Sustainable Finance Disclosure Regulation (SFDR) established a transparent, standardized framework for sustainable investment. Specifically, the regulation defined two distinct classifications of sustainability-linked financial products: Article 8 funds, which are required to promote environmental and/or social characteristics among other characteristics (and ensure good governance across all portfolio companies), and Article 9 funds, which are required to have a sustainable investment objective and thus only invest in companies qualifying as ‘sustainable investments’ (as defined in the SFDR).

For funds investing under Article 9, like Summa Equity Fund III, it is important to understand what qualifies as a “sustainable investment”.

Two questions in particular demand our attention:

a) Harm: What may not qualify as a sustainable investment given the risk of potential harm? What is the threshold for avoiding adverse impacts and practicing good governance? SFDR outlines criteria to disqualify investments that create significant social or environmental harm (aligned with the Principal Adverse Impact indicators) as well as investments that fail good governance practices.(1) However, the regulation leaves room for interpretation as to the point at which an investment generates significant harm and risk.

b) Sustainable contribution: What qualifies as sufficient contribution to solving an environmental or social problem? Can contribution evolve over the course of ownership? SFDR indicates that Article 9 investments must “contribute” to social and/or environmental objectives. (2) But the guidelines do not specify what counts as “contribution”. For instance, funds can choose to align or not align sustainable investment objectives with the EU Taxonomy (which in itself has yet to be fully defined). Funds that decide not to align with the EU Taxonomy can choose other indices as a reference benchmark to define sustainability – yet even this is optional as long as they explain how sustainable investment objectives will be pursued.(3),(4)

This document clarifies how Summa navigates these questions through a succinct impact strategy and decision-relevant framework for evaluating impact throughout the investment process.(5)

Summa’s impact investment strategy

Summa creates impact by investing in companies that contribute to solving a social and/or environmental challenge, as aligned with the UN Sustainable Development Goals (UN SDGs) and including companies focused on governance in the service of helping solve environmental or social challenges. (6)

Specifically, investment opportunities reflect strong:

- Impact alignment: Core business aligns with an environmental or social challenge, with impact outcomes identified and aligned against the SDGs and, where relevant, aligned with the EU Taxonomy (although Taxonomy alignment is not a criterion for investment)

- Impact contribution: Business can help solve the specific environmental and/or social challenge identified, as evaluated based on six contribution considerations (see next section)

- Impact fundamentals: Business has minimal risk of failing Do No Significant Harm test (including assessment against Principal Adverse Impact indicators) and meets basic good governance tests

Summa invests in companies at the leading edge of sustainability in their industry, as well as companies with an emerging sustainability platform that are well-positioned to evolve into leaders over the holding period. Investments focused on developing impact leaders may require more resources to support evolution of the business model. Given this added focus on investor contribution, Summa seeks to balance investments across companies already leading on sustainability and those with the promise to become leaders.

Impact in the investment process

Impact is integrated across Summa’s investment process, including impact considerations for screening, due diligence, and the path to value creation.

Impact alignment screening (from actionable deal to indicative bid)

In the first stages of the investment process, companies are screened for impact alignment within the appropriate Summa theme, and deals representing low impact potential are deprioritized. Specifically, deal teams are asked to define the core environmental and/or social challenge(s) addressed by the investment, including relevance to specific SDGs. This includes:

- Briefly articulating the core challenge and way in which the business helps solve the challenge

- Assessing whether the company reflects a sustainability leader today or can evolve into a leader given the core challenges addressed (preliminary perspective)

- Generating potential impact KPIs to track progress, including output and outcome metrics

The impact alignment step creates the foundation for impact in the investment process: it clarifies how an investment seeks to achieve sustainability through social or environmental benefits and forms the basis against which contribution can be assessed during due diligence.

Impact due diligence

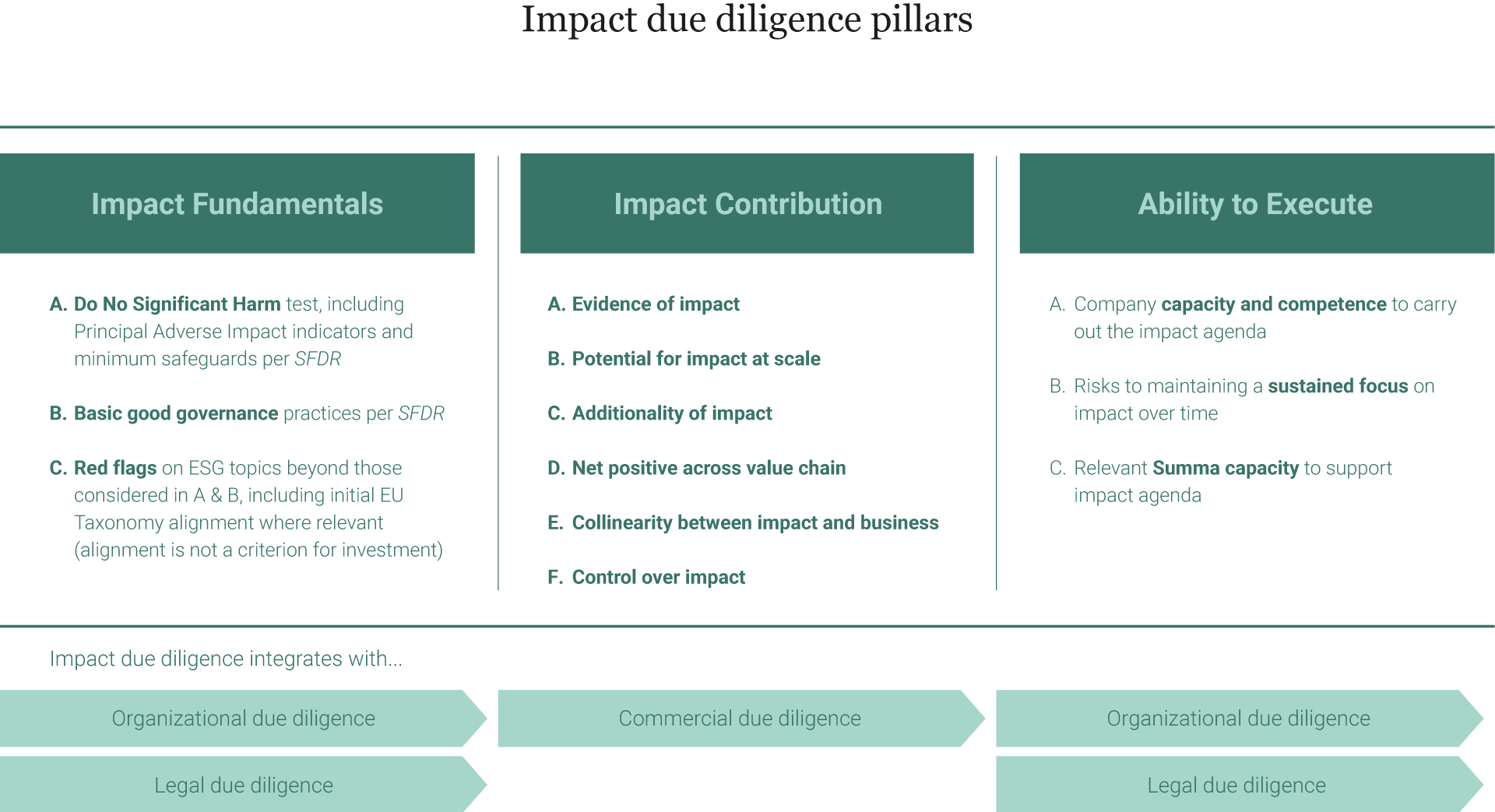

After the initial impact alignment stage, impact due diligence is performed. Impact due diligence includes assessment of the target company against three pillars (see Appendix for detailed criteria):

- Performance against fundamental impact elements focused on Do No Significant Harm and good governance, with harm assessment based on a company’s industry, most relevant regulatory guidance, and region; where relevant, this pillar also includes preliminary assessment of EU Taxonomy alignment (although Taxonomy alignment is not a criterion for investment)(8);

- Potential for contribution to address the core environmental and/or social challenges identified in screening, including evidence of impact, potential for impact at scale, additionality of impact, potential for positive impact across the value chain, collinearity between business and impact opportunities, and control over the impact; and

- Ability to execute on this impact contribution, including Summa’s capacity to support the company’s impact contribution.

Impact due diligence is focused on the core business as it is today, and where relevant may also consider how the business is expected to evolve during the holding period. Where companies are not already leaders in sustainability, it is particularly important to evaluate the company’s ability to execute on impact and consider Summa’s capacity to support the company’s impact journey.

Deal teams often engage expert partners to lead the impact due diligence, including due diligence providers with environmental sustainability expertise as well as other technical areas of expertise as needed. Where relevant, the impact due diligence is also integrated with other diligence processes, including commercial due diligence (relates to contribution), organizational due diligence (relates to ability to execute and impact fundamentals), and legal due diligence (relates to impact fundamentals and ability to execute).

Impact in the path to value creation

Recommendations for impact-aligned value creation

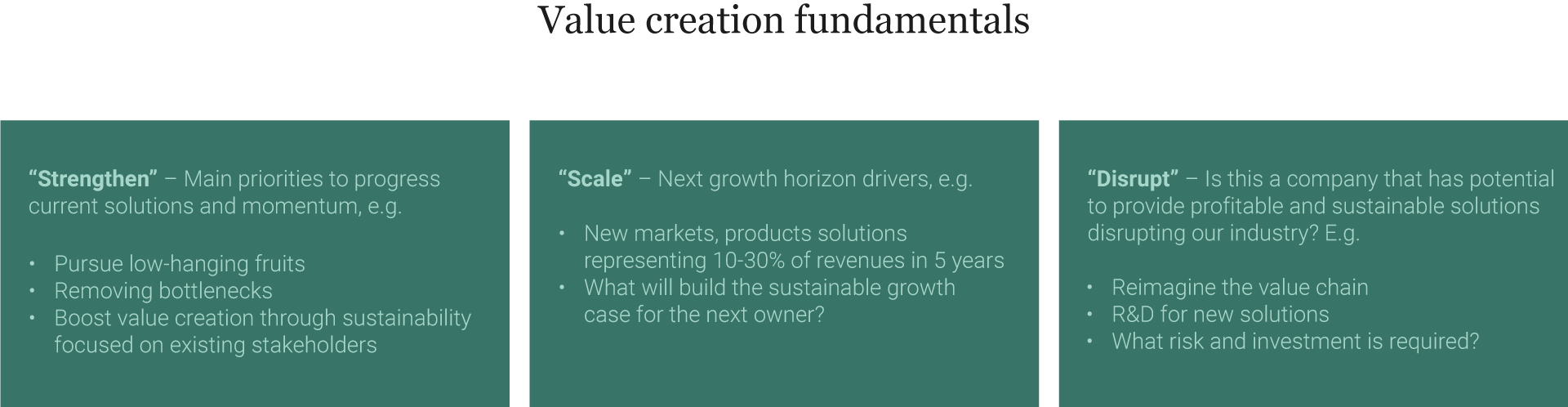

Deals brought to the investment committee also include recommendations for value creation, which serve as a starting point for Summa’s approach to portfolio management during ownership (called “Via Summa”). These recommendations focus on relevant levers to advance impact based on the impact due diligence, including:

- Critical gaps to close (value protection): Near-term priorities to address gaps related to impact fundamentals and to bolster impact capacity where needed (e.g., implementing additional good governance expectations)

- Opportunities to advance impact (value creation): Near- and long-term priorities to integrate impact via strengthen, scale, and disruption opportunities, as part of Summa’s three-phase plan for the company

Impact through active ownership

Value creation recommendations during the deal process serve as the foundation for an active approach to portfolio management. Summa continuously evaluates relevant impact priorities and opportunities during ownership and through to exit, which is part of our ambition to future proof companies and sell at a point when company growth is aligned to impact.

Two types of impact advanced during ownership

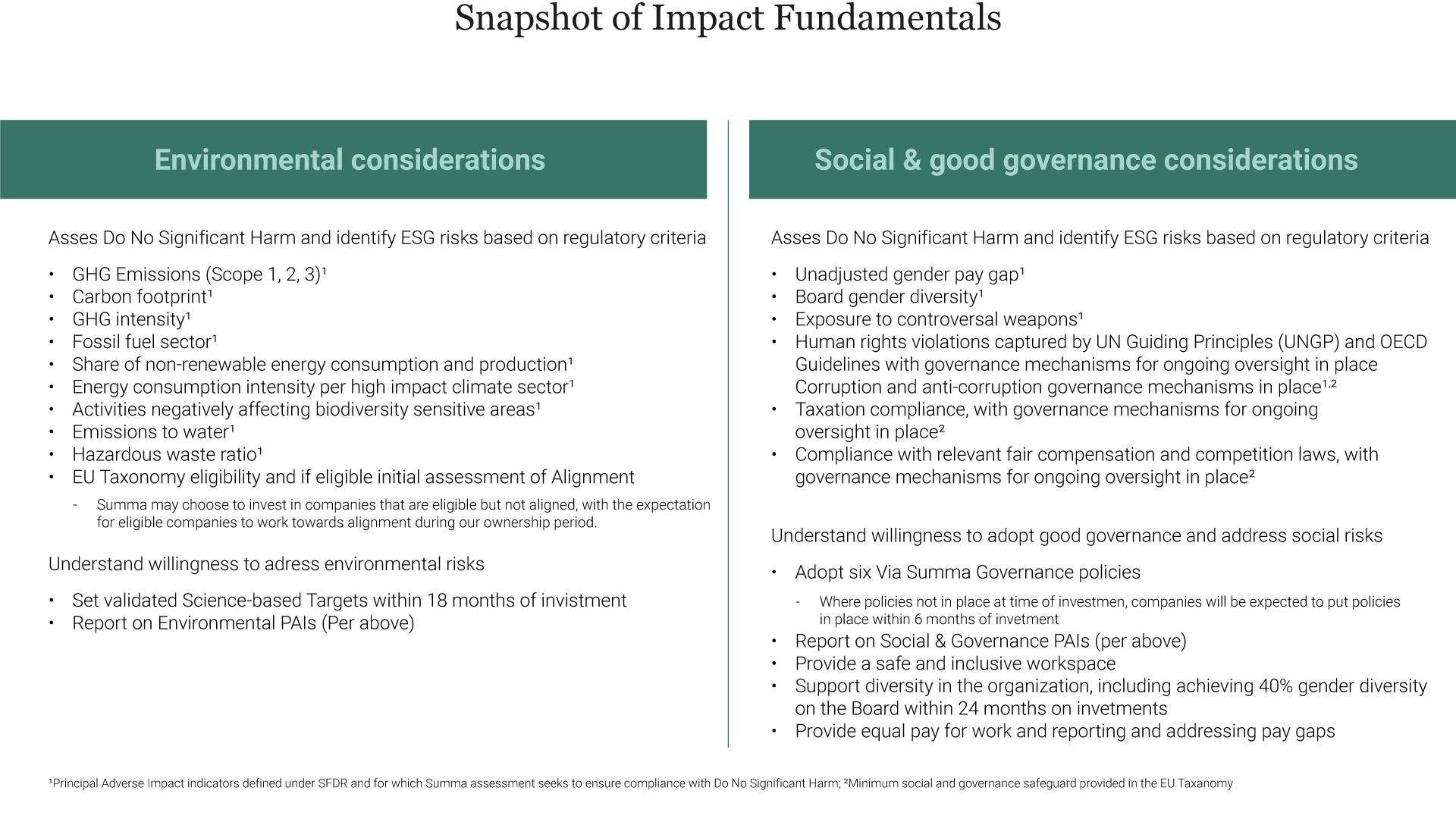

Active ownership includes engagement and capacity building for investee companies on fundamental impact areas, for which Summa sets shared goals for all companies, such as setting Science-Based Targets and achieving gender balance in corporate boards. These 4 topics extend from the areas considered during the impact fundamentals component of due diligence.

In addition, active ownership includes helping companies advance contribution aligned with the social or environmental challenges identified in the investment process. These opportunities are often directly linked to the core business model or strategy and reflect “game-changing” impact opportunities.

Where possible, Summa seeks to align game-changing impact to a strong theory of change, including helping define a clear impact ambition, articulating how a company can achieve that ambition directly and indirectly, and tracking leading and lagging indicators.

Summa is also committed to strong impact measurement. Portfolio companies are required to report on both fundamental and game-changing impact along with financial reporting. This reporting includes data snapshots aligned with the Principal Adverse Indicators.

Appendix A: Overview of impact due diligence criteria

I. Impact fundamentals:

Does this company have the ‘house in order’ when it comes to impact fundamentals as addressed in the SFDR and, where relevant, the EU Taxonomy?

Synced with LDD and ODD

A. Do No Significant Harm:

Does the investment meet Do Significant Harm (DNSH) requirements under SFDR? If there is risk, how will Summa materially reduce risk?

B. Good Governance:

Does the company have basic good governance in place, including Via Summa compliance and EU Taxonomy minimum safeguards?

- Does the company pass good governance test for sound management structures, employee relations, remuneration of staff, and tax compliance?

C. Red Flags:

Are there any red flags on ESG topics beyond those considered under SFDR and EU Taxonomy? For companies that are EU Taxonomy eligible, what is the initial view of Taxonomy alignment?

II. Contribution:

Does the investment contribute to addressing specific environmental and/or social challenge(s) as identified in impact alignment screening?

Synced with CDD where relevant

A. Evidence of impact:

What is the evidence base for impact?

- Does the approach represent a known/proven solution? Does the company have a track record of driving impact outcomes?

- What percentage of the business (e.g., in terms of revenue) is aligned with positive impact?

B. Impact at scale:

What is the potential for impact on this problem, if the company were operating globally?

- Could the company move the needle on the challenge if global (e.g., address 5% of GHG emissions from food) or drive an inflection point (e.g., change rules of the game for all players)?

- How does scale potential relate to depth or duration of impact?

C. Additionality:

Does the company represent additionality in impact? Will it inspire others in the industry?

- To what extent does impact go beyond existing trends and standards, due to better performance on core sustainability issue and/or a more accelerated path to impact at scale compared to peers? Quantify relative to peers/standards wherever possible.

D. Positive across value chain:

To what extent does the company drive positive impact on the relevant challenge(s) across the full value chain, including upstream and downstream?

- Where upstream and/or downstream factors have a large effect on relevant outcomes, how can the company influence these factors as part of its contribution to the problem?

E. Co-linearity:

Does the impact opportunity represent co-linearity with the business today or in the future (i.e., as business grows, impact grows)?

- Where relevant, what is the business case for evolving a company’s business model to greater impact (e.g., how does it future proof the business)? What is the expected cost/investment needed?

- How are impact goals aligned with, or in opposition to, priorities around margins, value proposition, and growth? Given this, what are potential value creation levers aligned with impact?

F. Control:

Does the company have meaningful control over impact, or indirect influence?

- To what extent is impact dependent on customer decisions, e.g., a customer choosing a more sustainable product over a less sustainable product that is also offered or using products in a specific, more sustainable way?

- How many steps exist between a company’s output and the desired impact outcomes? Over what timeframe will this play out, and what are the most important assumptions? Put another way, what do you have to believe about factors outside the company’s control to see impact (e.g., upstream suppliers will shift in X way)?

III. Ability to execute:

Can the company execute on this impact agenda?

Synced with ODD and LDD where relevant

A. Company impact capacity:

Does management and the organization at large have the necessary capacity, capabilities, and commitment to drive the impact agenda?

- Where a company is not already a sustainability leader, is there a foundation of impact performance and management commitment from which to drive impact?

B. Sustained focus:

What is the risk that other business imperatives supersede or interfere with impact?

- What resources or processes exist or can readily be added to help sustain impact over time?

C. Summa capacity:

Does Summa have sufficient ownership/control and capacity to drive impact?

- What is needed from the Summa team as active owners, and do we have that capacity and competency? How will Summa manage risks (real and reputational)?

Impact-aligned value creation

Questions to consider as part of developing impact-aligned value creation plans

A. Critical gaps:

- What are the most important gaps to close in the first 6-12 months to improve impact fundamentals and ensure necessary capacity to drive impact contribution over time?

B. Value levers:

- How does impact align with value creation thesis, including priorities to Strengthen, Scale, and Disrupt? How might this evolve over the three-phase plan?

C. Risks:

- What are the most important risks to achieving the intended impact? What are potential unintended consequences, and how might they be managed?

D. Impact metrics:

- What are the most relevant key performance indicators (KPIs) to track progress impact contribution, including output and outcomes measures? Given current performance and what is needed to have impact, what might be reasonable multi-year targets for these KPIs?

Footnotes

(1) As outlined in Article 2.17 SFDR, investments are not sustainable if the investee company causes significant harm to environmental or social objectives and/or fails to follow good governance practices with particular respect to management structures, employee relations, renumeration, and tax compliance.

(2) SFDR Article 9 guidance refers to environmental and social outcomes specifically, while also requiring that funds ensure all investee companies have good governance practices. Summa’s approach aligns with this and recognizes governance solutions as contributing ultimately to environmental and/or social challenges.

(3) Summa has not designated an index as a reference benchmark for sustainable investment objectives. As such, under Article 9.2, Summa has included an explanation of how sustainable investment objectives will be attained per the Fund III Pre-Contractual Disclosure and the additional guidelines laid out in this document.

(4) As in Summa Equity’s Fund III Pre-contractual Disclosure: “The most relevant EU Taxonomy-related contributions for underlying investments with an environmental objective are: a. climate change mitigation; and b. the transition to a circular economy. The Fund, however, is not exclusively focused on environmental objectives, and neither eligibility nor alignment with the EU Taxonomy is a binding criterion for investment. The Fund may select investments aligned with either of the four other EU Taxonomy environmental objectives, as well as investments that are not Taxonomy aligned.”

(5) This memo focuses on Summa’s approach to navigating Article 9 requirements as relevant for investments from Summa Equity Fund III.

(6) As in Summa Equity’s Fund III Pre-Contractual Disclosure: “The binding element of Summa’s investment strategy is that our portfolio companies deliver products or services with a meaningful contribution to one or more of the United Nation’s 17 SDGs.”

(7) Summa invests across three thematic areas: Resource Efficiency, Changing Demographics, and Tech-Enabled Transformation. Each thematic area represents a set of social and environmental challenges and a theory of change. Investments should align with the challenges and theory of change for the relevant thematic area.

(8) Evaluation of impact fundamentals covers characteristics that disqualify investee companies from sustainability per SFDR guidance and as laid out in Summa Equity’s Fund III Pre-contractual Disclosure, including: commit to Do No Significant Harm principle; commit to strong standards of good governance; comply with minimum social safeguards; perform no Human Rights abuses and commit to Human Rights due diligence in supply chain; commit to reporting on Principal Adverse Impact Indicators; provide a safe and inclusive workplace; support diversity in the organization; commit to equal pay for work and reporting and addressing pay gaps; employ adequate safeguards against discrimination and harassment; do not create substantial ecological harm.

The Summa Summarum newsletter

Sign up to our newsletter

Latest readings

News

Inspiring leadership for impact: Summa Equity’s CEO Learning Journey at Harvard Business School

Read more

Summa Equity owned myneva Group continues its growth journey with the acquisition of DM EDV

Read more

Measuring what matters: How impact accounting redefines sustainability measurement

Read more

Summa Equity completes EUR 800m Fortum Recycling & Waste acquisition, combining with NG Group: “We are creating the Nordic leader in the circular economy”

Read more

Summa Equity merges Sengenics into Standard BioTools to broaden its proteomics offering

Read more